This post offers a gentle introduction to how energy markets work for folks who are more used to spending their time at “the next layer up in the stack” building digital services. By the end of this post, you will have a better understanding of the economics of transitioning digital services to fossil free power.

We need a fossil free internet by 2030

Why? Because it will save lives, save gigatonnes of carbon being emitted into the sky, and it will also save a bunch of money. If you have been following trends in the energy sector around how the price of renewable has fallen, you already know that this is plausible.

Over the last 20 years, a fossil free internet has become just desirable, not just from a “climate justice and sustainability point of view”, but also from a “simple economics” point of view. Let us see how that works.

The stack below the internet

Very (very) generally speaking, when we turn on a light switch we get electricity from an organisation that operates a grid (our grid operator). That grid operator typically buys electricity from organisations that generate electricity to sell into a grid (our generators).

Terms to help us think about the grid

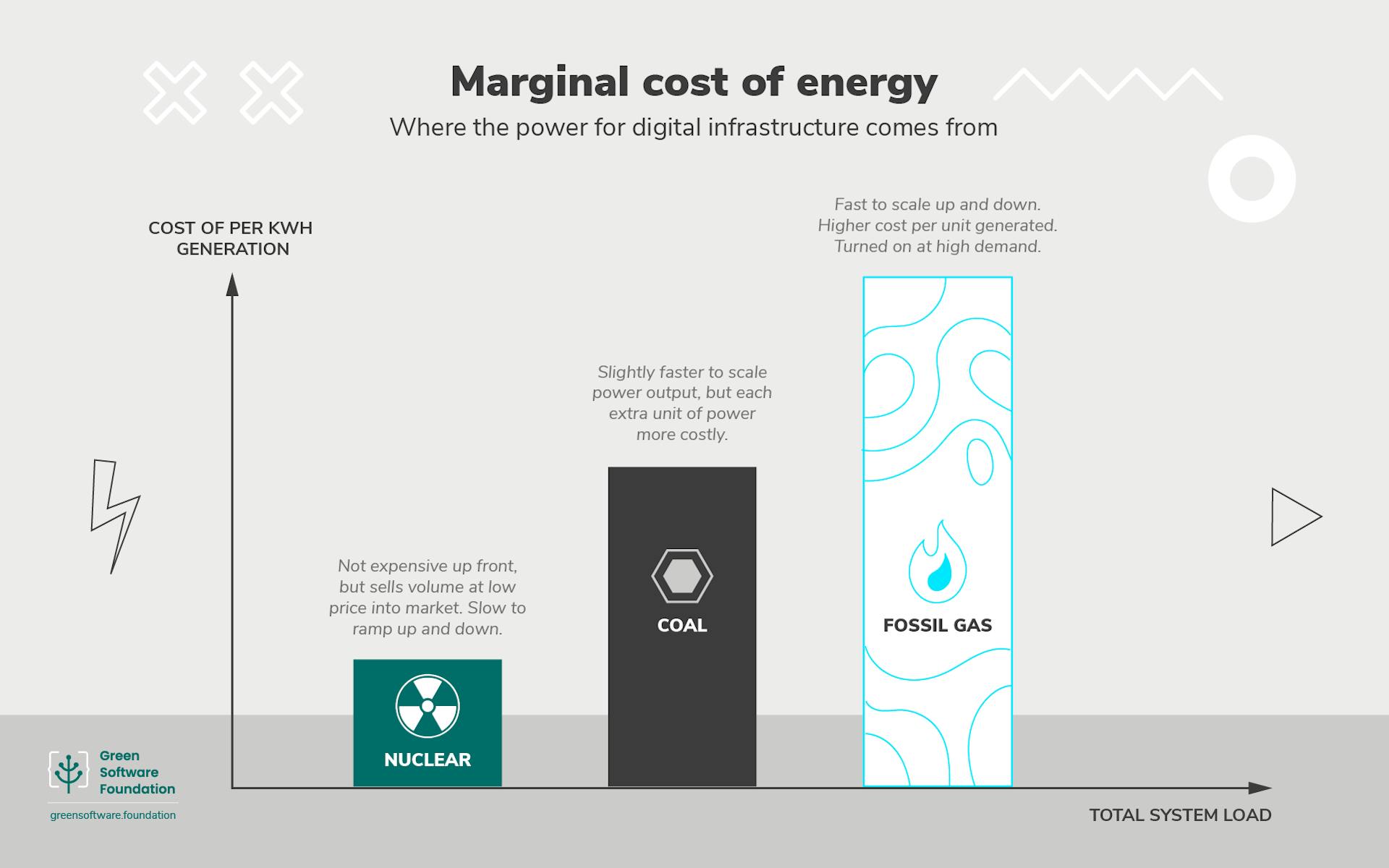

There are lots of different ways to generate electricity. In the diagram below I’ve listed three—nuclear, coal and fossil gas—which make up a significant share of most electricity grids in the world.

But to help us think about all of this, it’s useful to understand three concepts: total system load, cost of electricity and the capacity factor.

Total system load

First is the total system load – which is the total amount of power the grid needs to provide to everything using electricity. When everyone in a country is using lots of electricity, the total system load is high. At night, when fewer of us are using so much electricity, the total system load is usually low.

Cost of electricity

Second is the cost of electricity, usually measured in terms of the cost per kilowatt hour. Energy is often bought and sold on wholesale markets, and the price will often reflect demand. When lots of people want to use electricity the cost that generators can sell it for will be higher than when demand is low.

As demand for power on a grid increases, so does the cost people are prepared to pay to use electricity. We might refer to this increasing cost of each extra unit of electricity we produce to meet demand as the marginal cost of electricity.

Most of the time, we don’t see these price fluctuations in our everyday use, because electricity markets are regulated, and these changes happen on a wholesale market that only certain players have access to. These players might be the energy retailers most of us buy our electricity from for our homes, or large users of energy in the commercial and industrial sectors, like hospitals, data-centre operators, factories and so on.

Capacity factor

Finally, the last one is the idea of a capacity factor. If you own a car, and you are constantly driving it 24 hours a day, 7 days a week, you could say you’re using it 100% of the time; and the capacity factor would be 1.0. This is pretty ridiculous even if it was possible for an owner to drive their car all the time. However, the reality is that most cars are used a tiny fraction of the time instead. That is, the capacity factor would be much, much lower than one.

You can use the idea of a capacity factor to talk about how much something is being used in reality, compared to how much it could be used.

Applying our new terms

Armed with our new terms we might say:

Over a year, the total system load on our electricity grids will fluctuate over time as demand changes.

Even though most of us are not exposed to it directly, the cost of electricity changes to reflect this demand.

Not every form of electricity generation is used all the time, even if they could theoretically run 24/7 over the entire year, and most won’t. Some will be used more than others, so capacity factor will be different across these different forms of electricity generation based on the role they play in meeting demand.

Charting out different ways to generate electricity

We can use these terms to help understand how the economics of electricity are changing, by looking at the economics of various forms of generation in turn.

There are different properties for different sources of power on the grid. For example, when there isn’t much load on the grid, nuclear generation might sell into the grid ‘first’. Let’s look at why.

Nuclear power

Nuclear—or at least the current generation nuclear we see generating power on lots of grids today—is known for taking a really long time to build, and is expensive to build. But once it’s set up, you can get a lot of electricity for each unit of nuclear fuel. This means that generators might be able to sell electricity at a low price. But because the plant was so expensive to set up, it pretty much has to sell a high volume of power. That is the only way to really recoup the upfront costs. Often one of the best ways to do this is to agree to sell a lot of it at a low unit price into the market.

This is compounded by the fact that it’s not easy for nuclear plants to ramp the power output up or down at short notice. If you can’t easily control how much power you’re generating, you’ll again need to ensure you have people agreeing to pay to use it. One way to do this is to sell your power into a wholesale energy market at a lower price than you might otherwise. This is why you can see nuclear represented on the chart as selling at a lower cost of electricity than the other forms of generation.

To use our terminology, nuclear will need to be run at a high capacity factor, but often choose to sell at a low cost of electricity. As a result, when the total system load is low, nuclear will be making up a decent chunk of the power fed into the grid.

Coal

Compared to nuclear plants, a coal fired plant is faster and cheaper to build. It has a relatively lower capital outlay upfront. However, you can’t get anywhere near as much energy from a kilo of coal, as you get from a kilo of nuclear fuel. You need to buy much more coal to burn to generate the same amount of power. This means that the cost per unit you can sell into a market and break even has to be higher.

Also, because you’re working your way through huge amounts of coal, you typically end up emitting a much higher volume of harmful by-products like carbon dioxide, other toxic gases, and ironically, even radioactive material in the ash left over from burning the coal.

On the other hand, ramping up or down power output—while complicated—is cheaper and easier than with nukes. For this reason, when there isn’t demand on the grid, and the price people are prepared to pay for coal is lower than the cost of running the power station, one option available is to just switch off the power plant. It doesn’t make money from selling power, but it doesn’t have to pay to burn coal either.

Here the capacity factor might be lower than with nuclear, and coal fired plants might come online when total system load is slightly higher too. When the cost of electricity is below a certain level, it might not make sense to run a coal fired power station because it costs more to generate the power than you can get for selling it. In 2008 the average coal fired power plant globally ran 90% of the time over a year. In 2018, that figure was around 56%, as it became harder to run a coal-fired station at a profit.

Gas

Gas by comparison might use more expensive fuel to generate electricity. But, it’s often cheaper and faster to build a gas-fired power plant than a coal or nuclear one. On top of this, it’s much easier to ramp supply up and down quickly with a gas fired power station. This means that gas power stations can wait for the cost of energy to be relatively high before selling into the grid, and just not sell at all when the cost is low. Because it sells into the grid at a high price, it can still be profitable, even though over a year it is in much less constant use than the other two kinds of power plants.

To use our terminology, if you run a gas generator, you can still make money even if you have a very low capacity factor. This is because you can wait until the total system load is very high, and sell power when the cost of electricity is correspondingly high too.

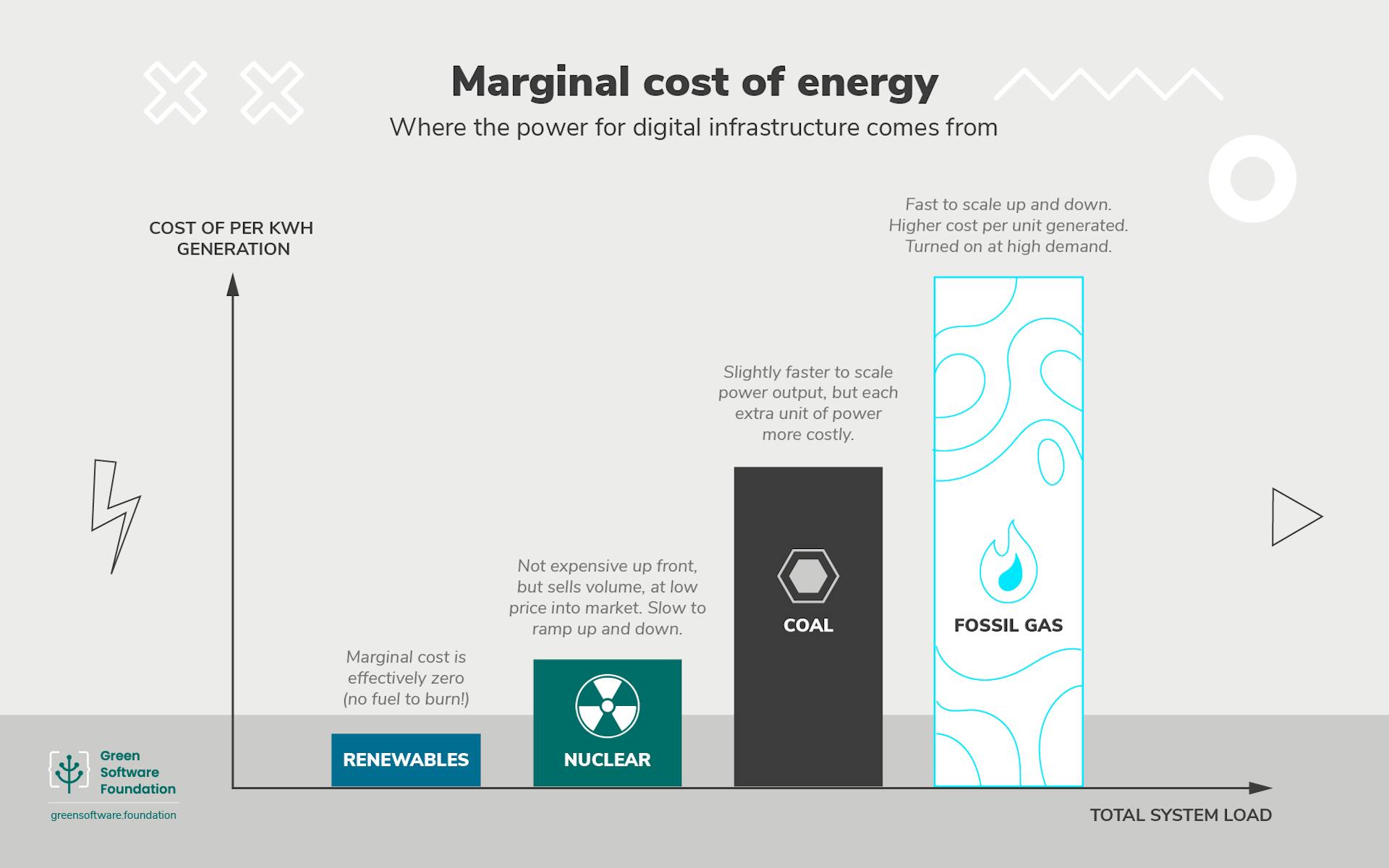

How cheap renewables have changed this

Over the last 10 years we’ve seen the price of solar absolutely plummet. It is nearly ten times cheaper than it was in 2010. Wind’s price has come down less quickly, but it was also cheaper to begin with too. We’ve represented these with the blue block in our diagram.

Renewables, as you might guess, don’t rely on fuel to make energy. Once you’ve set them up, they harvest energy from the environment around them. Essentially, the fuel for renewables is free.

This means they can sell into a power market at an even cheaper price than nukes, but they can only do so when it’s windy or sunny. As you’d imagine, this doesn’t make people who own nukes happy, as now someone is undercutting them, pushing down the price further, but only when it’s sunny and windy.

So, their capacity factor might be lower than other forms of generation, but because there are no fuel costs, they can sell electricity at an even lower price than nuclear. And they can do so even when the total system load is low.

Also, because you have this variable source of energy feeding into the grid, managing supply and demand gets harder. At times you can end up with periods of over-supply. In these cases, when there’s more supply on the grid than demand, the grid operator has a decision to make. They can reduce the price they’ll pay, which will result in some generators no longer selling into the grid, or in some extreme cases, they can ask operators to scale back production.

As mentioned earlier, it can be complicated and risky to scale back generation for some generators, especially for big nuclear plants. Because of this, grid operators might sometimes have to pay a generator to scale back their power, to account for the extra expense and risk of damage to the power station incurred when doing so. Another option is to just reduce the price so much that people will use more power, balancing things out by increasing demand, instead of reducing supply.

This means that sometimes demand can go so low that it goes negative. That is, you can be paid to use power if you are able to tap into wholesale power markets.

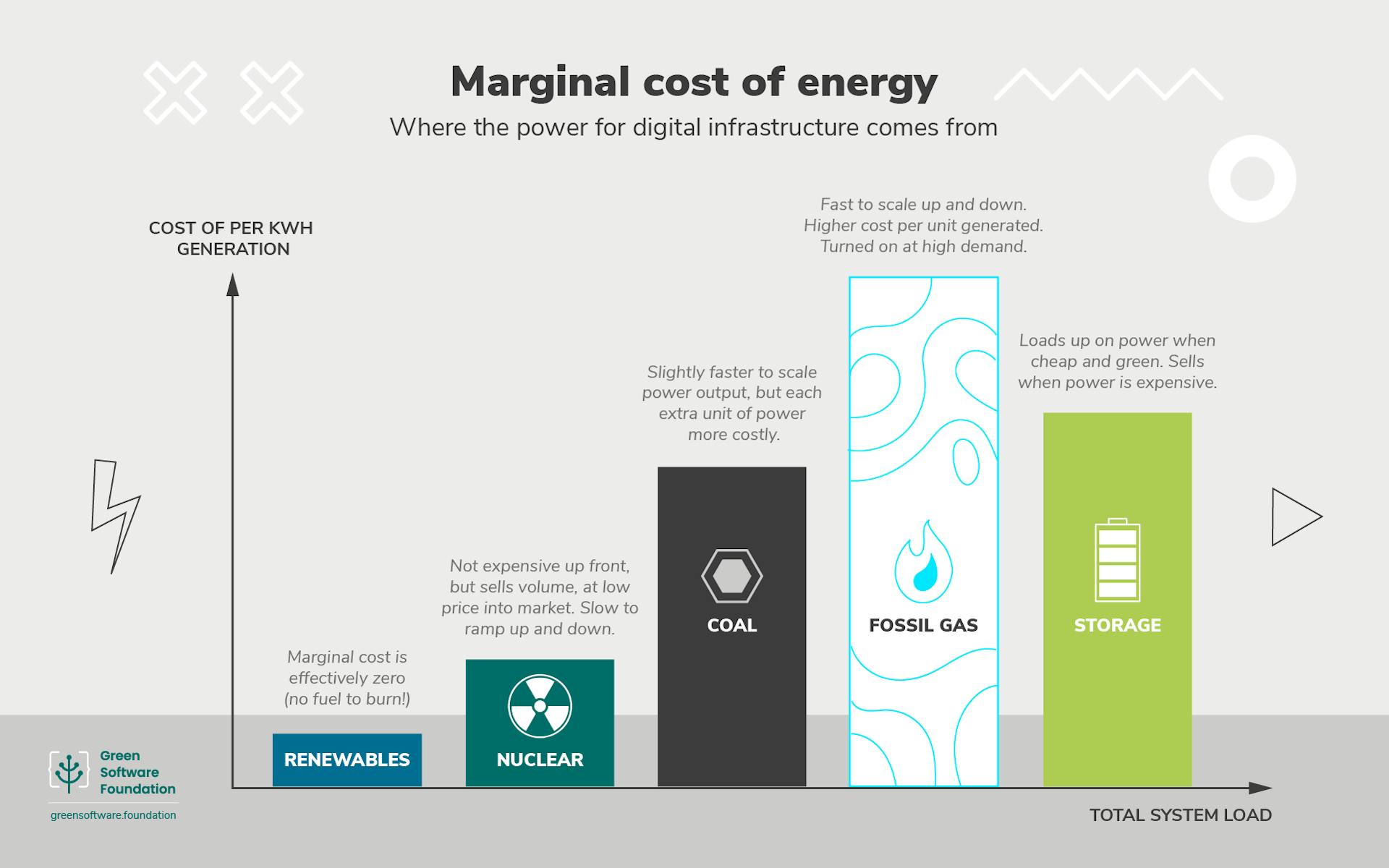

Cheaper storage and batteries change this even more

Renewables and batteries have effectively created a pincer movement on fossil fuels.

Over the last decade, we’ve also seen the price of battery storage fall. Today they’re between eight and ten times cheaper than they were in 2010. Batteries on the grid can do all kinds of interesting things to help the grid run more smoothly. But, for the purposes of this post, we’re just going to focus on two things they do:

Batteries draw power from the grid when energy is cheap to charge. If we’re on a grid where the price of power can go very low or negative, you can see how this would work for them.

Batteries discharge this energy back into the grid when demand for energy is high. We know that, as demand increases so does the price people are prepared to pay for power. They can take advantage of this, selling the same kilowatt hours for a higher price than when they went into the battery.

Just like gas fired power stations, batteries don’t need to be running all the time to make money. They just need to be able to store enough energy for it to be useful enough for people to be prepared to pay for it. A lot of the time, you don’t even need hours and hours of storage for this to be useful enough to recoup the costs of the battery, because a battery can cycle its charge so many times over a month or year.

If you run a gas-fired power station where you were only expecting to need to run part of the year, and now a bunch of batteries are undercutting the prices you expect to sell into the market at those times, you might be a bit miffed that batteries are becoming so popular.

I now tend to think of renewables and storage like a pincer movement from the future when it comes to energy markets: you have solar and wind getting ever cheaper, and squeezing fossil fuels at the bottom end. And you have batteries squeezing gas at the upper end.

Combined, this effectively makes it harder to make money with dirtier technologies like coal and gas. This explains the falling capacity factors for fossil fuels. As renewables get more popular, they keep getting even cheaper, which makes them even more popular, leading to prices coming down further and so on in a virtuous cycle.

The question isn’t if fossil fuels get kicked off the grids, it is about when. And in the 2020’s when it comes to climate, speed is justice.

Summary

In this post, we introduced the idea that marginal cost for generating power means that different kinds of power generation can end up being paid different amounts to generate the same power, depending on how much demand there is on the electricity grid at a given moment.

We also introduced how renewables are changing the economics of generating power. We looked at the top end, showing how batteries crowd out some ‘peaker’ fossil gas plants that run in reserve to meet spikes in demand when total system load is high. We also looked at the bottom end where solar and wind, with their lower costs per unit of electricity, end up giving coal a hard time too.

To sum it all up...

Nuclear is expensive upfront, but sells volume, at low price into the market. It is slow to ramp up and down.

Coal is slightly faster to scale power output compared to nuclear, but each extra unit of power is more costly.

Fossil gas is fast to scale up and down and has a higher cost per unit generated. It can be turned on at high demand.

Renewables have a marginal cost that is effectively zero because there is no fuel to burn!

Storage loads up on power when cheap and green and sells when power is expensive.

This is one of the reasons we think a fossil free internet by 2030 is both plausible and desirable. There is an obvious moral case for avoiding needless harm, but there is also a very strong economic one.

Using these ideas in future posts

In a future post, we’ll show how these same ideas can be used to help us think about a demand curve for compute.

Similar to how different forms of electricity generation can be combined to meet demand on the grid efficiently and sustainably, in a kind of demand curve, we think the same is possible at the next layer up the stack to match the kind of compute services you use to the workloads they’re used for.

Note: Although we mentioned this before, it bears repeating – energy markets are obviously much more complicated than this, and the post here is intended as a gentle introduction to an entire domain. Lots of detail has necessarily been left out for brevity.

Images adapted from: The Green Web Foundation

Originally published in the The Green Web Foundation Open Syllabus project